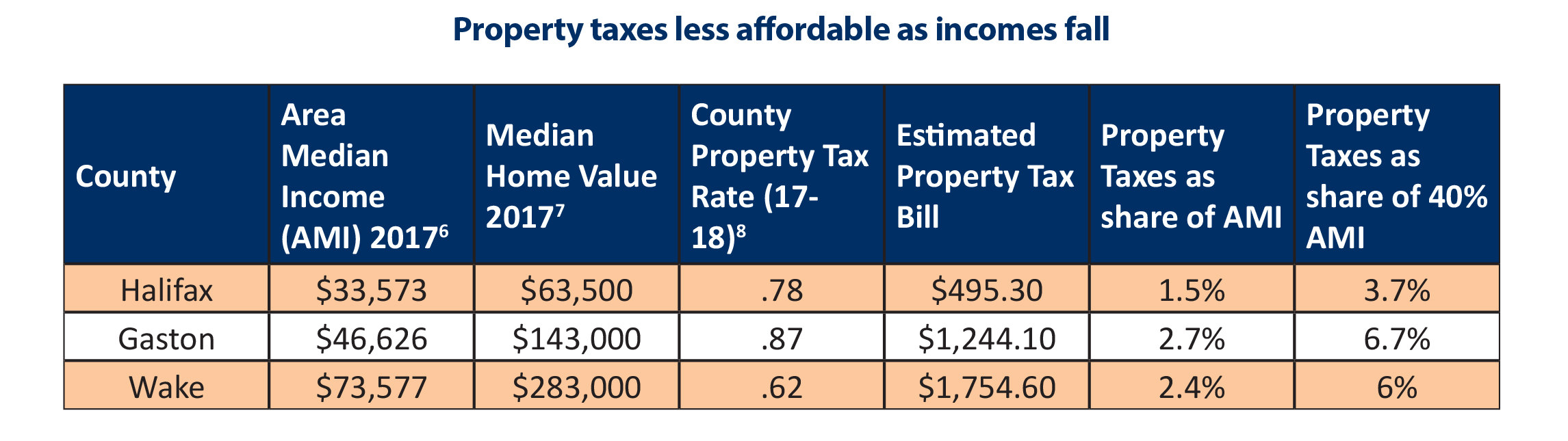

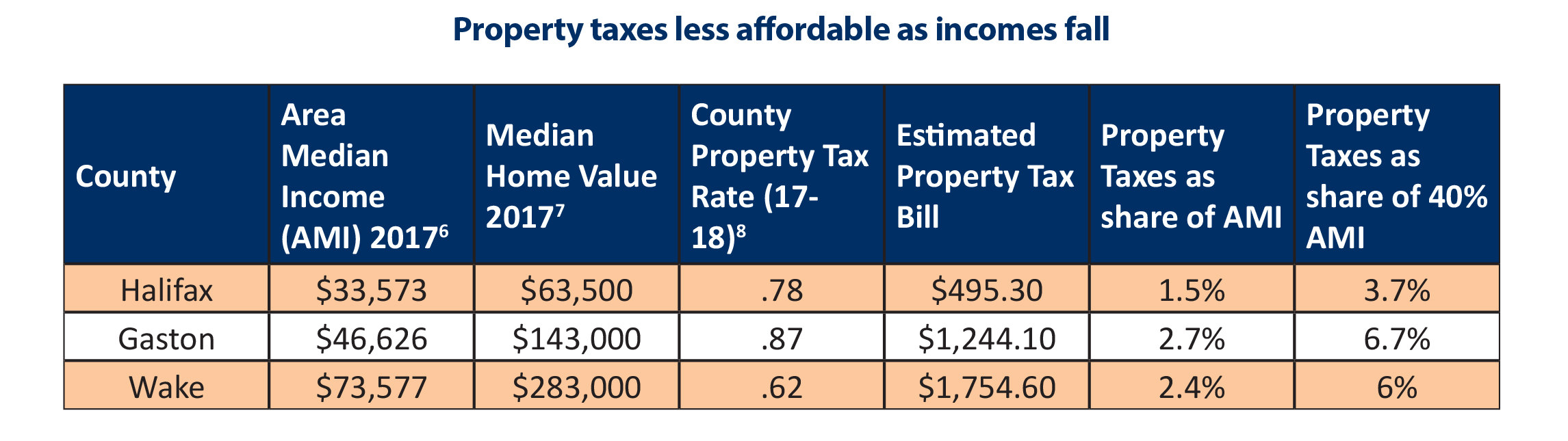

One of the most common interactions you may have with wake county government is through the payment of property taxes.

Wake county real estate tax rate.

Property owners as of january 1 are required to report any new buildings additions improvements and or deletions that occurred during.

Wake county makes no warranties express or implied concerning the accuracy completeness reliability or suitability of this data.

Enter your search criteria to locate property in north carolina.

This data is subject to change daily.

In a revaluation year tax bills are mailed to all real estate property owners.

If your taxes are paid through an escrow account with your mortgage lender you do not need to forward a copy of the bill to your lender or notify the tax office that your mortgage lender will be paying the taxes.

A tax lien attaches to real estate on january 1 and remains in place until all taxes on the property are paid in full.

2020 property tax bills.